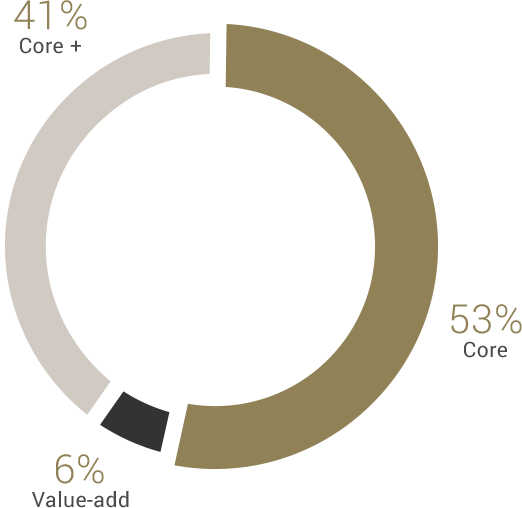

Our strategy is aimed at the creation, optimisation and active management of a high quality real estate portfolio characterised by potential for appreciation and able to generate increasing and sustainable cash flows. Particular attention is paid to the sustainability and energy performance of our buildings both in their current status and also taking into account potential refurbishments. Given current market conditions, we have opted to focus on the office segment in Milan, as it is the largest, most transparent and most liquid market in Italy