Market context

The real estate sector plays a key role in the economy, in the society and in the environment, as highlighted in a recent study published by EPRA1 (European Public Real Estate Association) and INREV (European Association for Investors in Non-listed Real Estate Vehicles).

A performing and functional real estate infrastructure provides fundamental support for achieving the full potential of an economy and its citizens. This aspect is even more relevant in a context characterised by marked demographic and behavioral changes, which make end users’ requirements of real estate products increasingly dynamic and demanding.

Aligning real estate supply with end-user demand is also the main prerequisite for achieving resilient and sustainable investment performance by institutional investors who typically allocate part of their portfolios to the real estate asset class itself.

Finally, the notion that the real estate sector is responsible for a large proportion of natural resource and energy consumption globally is now broadly consolidated, contributing directly and indirectly to a substantial proportion of CO2 emissions into the atmosphere (in particular, it is estimated that buildings and the construction sector are responsible for about 38% of the Global carbon emissions2).

The real estate sector and the entire supply chain for which the sector is part of (from the construction materials sector up to the involvement of tenants who occupy the buildings), plays a central role in the debate on climate change and are important channels for the development of specific actions to counteract the increase in global warming.

The integration of the ESG aspects (Environmental, Social and Governance) into the operations of a company have become significant and defining issues in the market today. Since the publication of the 17 Sustainable Development Goals (SDGs) and the commitments made by governments and businesses at the last Conference of the Parties on Climate Change (COP25), held in Madrid in December 2019, the year 2020 has seen a decisive acceleration of regulatory and financial action at the European level to further guide the path of decarbonisation of the economic and social systems.

In January 2020, the Green Deal was approved, a plan for sustainable investments aimed at directing European economic and social development by 2050, reducing net CO2 emissions to zero, in line with the commitments made towards the Sustainable Development Goals of the United Nations 2030 Agenda. The measures launched by the European Commission aim to mobilise public and private investments for approximately Euro 1,000 billion and will affect different industries and services, from energy to the construction sector.

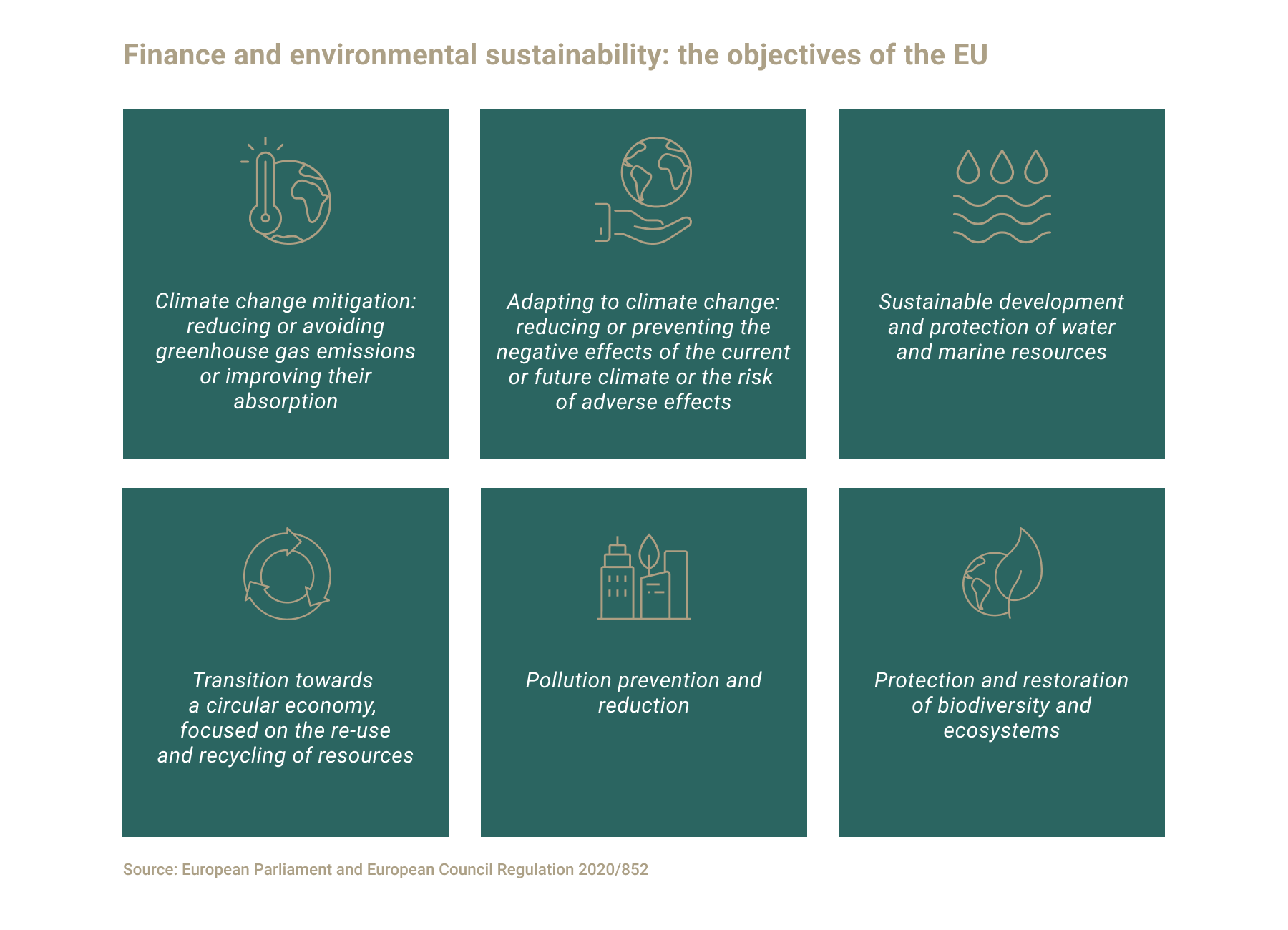

During June 2020, the Regulation no 2020/852 of the European Parliament and the European Council was approved, which for the first time contained the definition and criteria for the classification of sustainable investments. Among the economic activities regulated according to the objectives of limiting CO2 emissions, the entire real estate value chain has been included: construction of new buildings, renovation of existing buildings, timely measures for renovation, purchase and ownership of real estate, among which activities today contribute to approximately one-third of greenhouse gas emissions of which the European Union are attributable.

The EU taxonomy in support of sustainable finance will become fully operational by 2022 and will have a significant impact on the investment community, and consequently on the companies which are part of the investors’ portfolios. The result for the real estate sector will be the acceleration of a virtuous circle where the increase in the supply of buildings that meet high performance standards will encounter the investment demand from increasingly sophisticated operators in assessing risk and return profiles according to sustainability criteria.

1 Real Estate in Real Economy 2020 report. EPRA & INREV

2 2020 Global Status Report for Buildings and Construction, UN Environment programme